India-Australia Trade and Investment Trends and Prospects

Posted by India Briefing Written by Naina Bhardwaj

Trade prospects between India and Australia have mushroomed in recent years, propelled by the many complementarities between the two economies. Existing commercial and economic ties between India and Australia should rapidly improve after an early harvest trade deal is reached by the end of March 2022. This will be be followed eventually by the India-Australia Comprehensive Economic Cooperation Agreement (CECA) covering most trade in goods and areas such as services, investments, government procurement, and intellectual property. India and Australia hold their first virtual summit on March 21, 2022. Australia has also updated its India Economic Strategy to 2035.

In 2020, India was Australia’s seventh-largest trading partner and sixth largest export destination, driven by coal and international education. On the other hand, Australia is also an increasingly important destination for Indian exports. Below we discuss major import-export trends, investment growth areas, and the upcoming trade deal.

India-Australia 2022 virtual summit

Prime Minister Narendra Modi and Australian PM Scott Morrison are holding their first virtual summit on Monday, March 21.

At the virtual summit, Morrison is reportedly expected to unveil a INR 15 billion (AUS$ 280 million) investment package to boost cooperation across a range of areas that include education, clean technology, critical minerals, space, foreign trade, skills, innovation, and defense exchange. For example, Australia accounts for 55 percent of global lithium production and over 20 percent of global lithium deposits. India will look to Australia as a reliable supplier of lithium as the mineral is critical for production of electric vehicles and batteries.

As per sources quoted by the media, Australian government investments will include budget set aside for cleantech and critical minerals (INR 1.83 billion), space sector (INR 1.36 billion), setting up centers to promote bilateral ties (INR 1.52 billion), and skills development programs (INR 970 million).

Altogether, this would be the largest investment made by the Australian government into its bilateral relationship with India.

Trade and investment, defence and security, education and innovation, science and technology – in all these sectors we have very close cooperation. – Prime Minister Narendra Modi, India-Australia Virtual Summit

India and Australia have also agreed to hold an annual summit going forward, which will structure bilateral relations in a systematic manner.

Update: Australia’s Department of Foreign Affairs and Trade has released its Update to the India Economic Strategy to 2035. “An India Economic Strategy to 2035: Navigating from Potential to Delivery (IES)” was first presented to the Australian Government in 2018 offering a roadmap to deepen economic integration with India.

The 2022 Update provides a five-year action plan for the Australian Government and responds to evolving opportunities for both countries, changed global circumstances, the improving bilateral relationship, and key economic reforms in India. Priority sectors identified by the IES include technology, space, science and innovation, resources and METS (Mining Equipment, Technology, and Services) sectors, energy, health, education, agribusiness, defense, infrastructure, financial services, among others.

Status of free trade deal

On Sunday, March 20, 2022, Australian High Commissioner to India Barry O’Farrell told reporters, “We [Australia] are hopeful of signing the Phase one (early harvest) trade deal by end of this month.”

An interim / early harvest deal between India and Australia will lower import duties and expand market access for a limited number of items and sectors. Australian producers are focused on encouraging market access for products not made in India or commodities where India experiences a shortfall in supply, such as pulses, grains, and oilseeds. Indian interests lie in securing market access for its textiles, leather, and gems and jewelry.

The Indian government confirmed in January 2022 that sensitive dairy and agriculture items, such as milk, butter, milk powder, or wheat, would be kept out of the trade deal. Instead, the focus would be on items not produced in the country, such as blue cheese and Australian tree nuts like macadamias.

In meetings held between February 10-11, 2022, Goyal and Tehan’s teams identified key items to be prioritized for greater market access. Among these, the education sector was identified as offering mutually beneficial prospects for both countries. Among the reported proposals is the possibility of allowing Indian students to extend visas by an additional three-five years.

To read more, see India-Australia FTA Progress: Interim Deal Expected in March 2022.

Background

The formal resumption of negotiations on the India-Australia Comprehensive Economic Cooperation Agreement (CECA) took place during the 17th India-Australia Joint Ministerial Commission on September 30, 2021. During that meeting, both sides agreed to conclude an interim agreement or early harvest trade deal by December 2021, which was pushed forward to end of March 2022.

Bilateral trade and investment trends

India’s GDP in 2019 stood at US$2.97 trillion whereas Australia’s GDP during the same period was US$1.4 trillion. In the same period, while India ranked 44th in the Economic Complexity Index (ECI 0.59) and 15th in total exports (US$330 billion), Australia ranked 79th in the Economic Complexity Index (ECI -0.19) and 19th in total exports (US$284 billion). Bilateral trade between India and Australia was US$12.3 billion in 2020-21 and US$12.6 billion in 2019-20, with the trade balance in Australia’s favor.

India’s export basket to Australia majorly comprises of goods like petroleum products, medicines, polished diamonds, gold jewelry, apparels etc., while key Australian exports to India include coal, LNG, alumina and non-monetary gold.

In the services sector, major Indian exports to Australia are related to travel, telecom and computer, government and financial services, while Australian services exported to India are primarily related to education and personal services.

Sectors like food and agribusiness, healthcare, infrastructure as well as mining and resources have been gaining importance in the recent years.

In the healthcare sector, rising income, increased health awareness, and easy access to insurance are driving demand for newer ventures in Medtech as well as research and development (R&D).

In the food and agribusiness category, there is heightened demand in India for premium alcoholic beverages and wines, as well as health supplements and nutraceuticals like cold pressed juices, granola, and baked, gluten-free, and trans fat-free products.

India’s education industry is also rapidly expanding in the online segment, offering new opportunities for foreign investors looking to capitalize on young Indians seeking online training, upskilling, and hobby learning options.

Indian exports to Australia

In 2019, India exported US$3.19 billion to Australia. The main products that India exported to Australia are refined petroleum (US$287 million), packaged medicaments (US$277 million), and railway passenger cars (US$166 million).

Over 24 years, Indian exports to Australia have increased at an annual rate of 8.67 percent, from US$433 million in 1995 to US$3.19 billion in 2019.

Australian exports to India

In 2019, Australia exports to India amounted to US$15.3 billion. The main products that Australia exported to India were coal briquettes (US$12.1 billion), gold (US$604 million), and petroleum gas (US$419 million).

Over 24 years, Australian exports to India have increased at an annual rate of 10.5 percent, from US$1.38 billion in 1995 to US$15.3 billion in 2019. Education remains Australia’s largest service export to India, valued at US$4.46 billion and accounting for around 88 percent of the total in 2020. At the end of 2020, Indian students in Australia numbered 115,137.

Tariffs between India and Australia

In 2018, the products from India that paid the highest import tariffs to enter Australia were food preparations and grape wines, sparkling wines, fermented beverages, alcoholic drinks etc. at a tariff of 150 percent.

During the same period, the products from Australia that paid the highest import tariffs to enter India were vegetables and mixtures, both fresh as well as dried, including grapes, prunes, apricot etc. at the tariff of five percent.

Investment prospects

The total value of two-way foreign direct investment (FDI) between both countries was valued at US$1.04 billion in 2020.

India offers a multitude of investment opportunities to Australian investors as there is a heightened demand for upgraded infrastructure in rapidly urbanizing towns and logistics infrastructure. With the recently announced National Monetization Pipeline, the Indian federal government has invited investments to the tune of US$81 billion by monetizing its core assets in 13 strategic sectors through this pipeline, including railways, roadways, power generation, etc. Projects under India’s National Master Plan for Multimodal Connectivity to Economic Zones also creates multiple investment opportunities for investors.

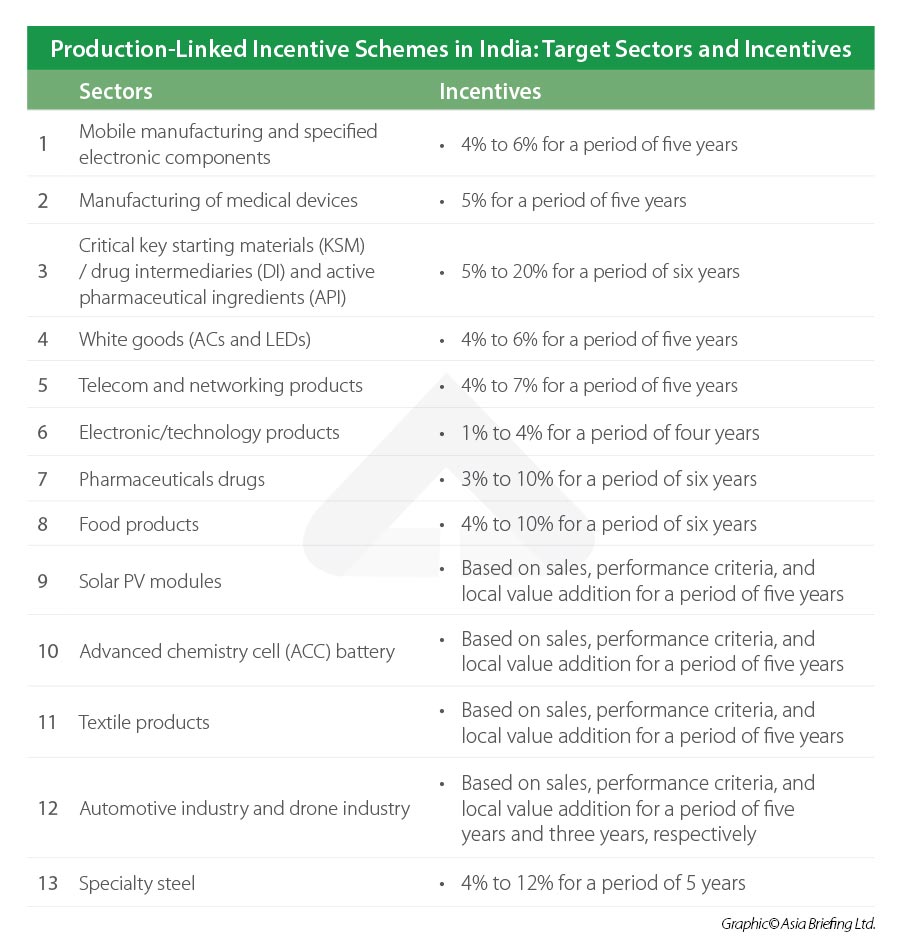

Besides infrastructure, India’s manufacturing sector is set to benefit from planned efforts by the government to boost specialized and value added segments across multiple industries, such as IT hardware, electric vehicles, ACC battery storage, drones, auto components, pharmaceuticals, solar modules, white goods, food processing, specialty steel, etc. Incentives are doled out based on the investor’s spending plans, sales, and creation of targeted new or higher-tech or value added production capacity. The cumulative impact of these production-linked incentives (PLI) is expected to see India become a much more competitive manufacturing and sourcing base by 2030.

India-Australia bilateral economic partnership

In 2020, both the countries elevated their bilateral Strategic Partnership concluded in 2009 to a Comprehensive Strategic Partnership (CSP). In September 2021, both countries formally agreed to reengage on CECA to foster cooperation in multiple areas, including critical minerals, health, critical technology, science, and agriculture. Fast track negotiations have meant the two sides hope to conclude an interim trade deal in the first half of 2022 followed by a full CECA in the next 12-18 months.

According to estimates by the Centre for International Economics, a 20-year period FTA could result in a net increase in Australia’s GDP by up to US$32 billion and India’s GDP by up to US$34.23 billion.

There are plenty of opportunities for trade and investment collaboration [between India and Australia] in priority sectors like resources and energy, Mining Equipment Technology Services (METS) including critical minerals, IT and emerging tech, agribusiness, education, and healthcare. – Petula Thomas, CEO, IACC

To aid Australian and Indian business partnerships, the Australian Government has launched the Australia India Business Exchange (AIBX) program. AIBX provides a range of services to support Australian businesses to enter and establish in India, from industry specific insights to guidance on doing business with India and entering India’s online retail market.

The Indo-Australian Chamber of Commerce (IACC) is the only bilateral chamber of commerce in India to promote trade and investment between the two countries. IACC is headquartered in Chennai, with Chapters in western India and Bengaluru. In March 2022, it launched the East India Chapter; the Northern India Chapter is also awaited later in the year. The IACC acts as a local guiding point for business growth and advocacy via business-to-business (B2B) and business-to-government (B2G) engagement.

This article was originally published on November 3, 2021. It was last updated March 21, 2022.

About Us

India Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Delhi and Mumbai. Readers may write to [email protected] for more support on doing business in in India.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, Singapore, Vietnam, Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.